are funeral expenses tax deductible in australia

The Australian Tax Office has recently confirmed that small businesses would be able to deduct ping-pong tables if used in the business but a whole range of employee entertainment expenses are. However only estates worth over 1206 million are eligible for these tax deductions.

Hsa Eligible Expenses In 2021 And 2022 That Qualify For Reimbursement

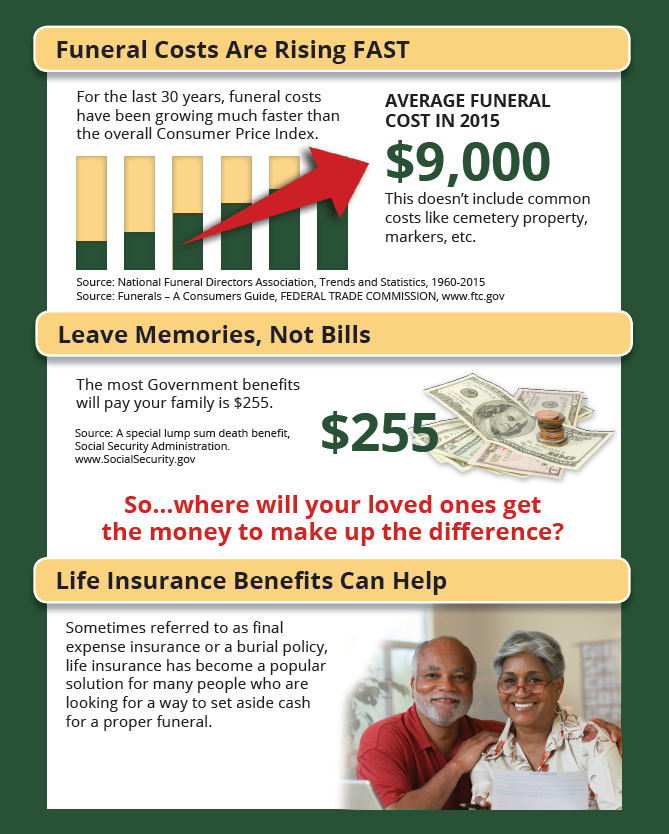

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases.

. As long as they are reasonable expenses the following expenses qualify for a tax deduction. However most estates dont qualify for this deduction unless the estate reaches the threshold of 12060000 the federal. If you are a beneficiary of a deceased estate.

Funeral expenses are included in box 81 of the IHT400. Most are work-related expenses you incur to earn your income as an employee. However not all burial costs are tax-deductible.

Occupation and industry specific guides. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. 27 May 2022 QC 23846.

This means that you cannot deduct the cost of a funeral from your individual tax returns. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. In short these expenses are not eligible to be claimed on a 1040 tax form.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. Taxpayers are asked to provide a breakdown of the expenses. Select your payment or service to find out how this impacts you.

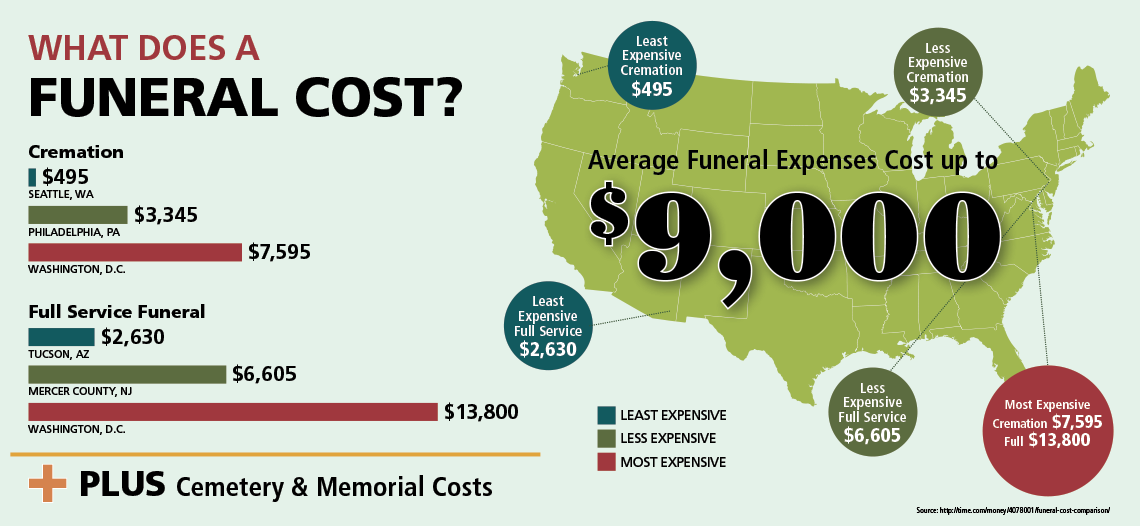

Work out if there is tax on money or assets you inherited or are presently entitled to. While the IRS allows deductions for medical expenses funeral costs are not included. The cost of transporting the body for a funeral is a funeral expense and so is the cost of transportation of the person accompanying.

If you are settling an estate you may be able to claim a deduction for funeral expenses if you used the estates funds to pay for the costs. Funeral service arrangement costs. There are some exceptions.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. The cost of a funeral and burial can be deducted on a Form 1041 which is the final income tax return filed for a decedents estate or on the Form 706 which is the federal estate tax return filed for the estate said Lauren Mechaly an attorney with Schenck Price Smith King in Paramus. More estates may be eligible for state tax deductions as many states have estate tax exemptions set much lower than the federal government.

Individual taxpayers cannot deduct funeral expenses on their tax return. The taxes are not deductible as an individual only as an estate. Deducting funeral expenses as part of an estate.

If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling.

An estate tax deduction is generally allowed for funeral expenses including the cost of a burial lot and amounts that are expended for the care of the lot. Confirming tax obligations are complete. Some estates may be able to deduct funeral expenses.

Funeral Expenses Tax Deductible Australia An estate tax deduction is generally allowed for funeral expenses including the cost of a burial lot and amounts that are expended for the care of the lot. Funeral costs you pay for in advance normally dont count in your assets test for payments from us. What Funeral Expenses Are Tax Deductible.

Services Australia acknowledges the Traditional Custodians of the lands we live on. Many estates do not actually use this deduction since most estates are less than the amount that is taxable. Where can a decedents funeral expenses be deducted.

Funeral home facility costs. You can claim deductions for some expenses you incur in your tax return. We pay our respects to all Elders past and present of all.

Mar 20 2020 You may be eligible for a compassionate release of super for funeral or. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs.

The deduction of reasonable funeral expenses is specifically allowed under IHTA84S172. Get your deductions right. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction.

Question Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines and floral costs are deductible. Check that all tax obligations are complete before the final distribution of the deceased estate. Funeral home director fees.

While individuals cannot deduct funeral expenses eligible estates may be able to claim.

What Do You Know About Life Insurance

Top Organizations That Help With Funeral Expenses

Taxes In Austria Everything You Need To Know Expatica

What Are Non Deductible Expenses Rydoo

Using Section 139 To Give Tax Free Payments To Staff During A National Disaster

Sars Tax Deductible Business Expenses Listed Deductions

Dying With Debt Can Prove Costly For The Survivors

Bitrefill Now Lets You Pay Your Bills Taxes With Bitcoin Nasdaq

Tax Information Every Musician Should Know Diy Musician

How To Deduct Medical Expenses On Your Taxes Smartasset

How To Start A Memorial Fund In 3 Steps

How To Deduct Medical Expenses On Your Taxes Smartasset

Cpp Death Benefit And Survivor Payment Kwbllp Accountants

Understanding Tax Deductions For Charitable Donations

How To Add Independent Contractors And Track Them For 1099s In Quickbooks Online